Some Known Details About Frost Pllc

All about Frost Pllc

Table of ContentsFrost Pllc Things To Know Before You BuyNot known Facts About Frost PllcWhat Does Frost Pllc Do?About Frost PllcExamine This Report on Frost PllcMore About Frost Pllc

A majority of well-known local business work with annual accounting professionals, yet annual accounting firms provide restricted solutions. They just manage your financial resources when the year mores than, so they aren't in touch with your company procedures in real time. This indicates you won't have timely data to aid you make fast decisions.Monthly accountants supply recurring support, recommendations, and understanding into your financial resources. This is considered a greater degree of service for small companies that see accounting as a financial investment, rather than just an expenditure without any return. At CSI Accounting & Pay-roll, we have actually supplied regular monthly audit to little businesses for over 50 years.

These statements show your revenues and expenses on a regular monthly basis. An important part of the, they can show you When you have questions about the money side of your company, you'll have a monetary professional all set to address them. If you intend to or, all you have to do is offer your accounting professional a call.

Your month-to-month accounting professional will ensure there are and. Reconciling your accounts monthly is vital to maintain your company on track.

Frost Pllc Things To Know Before You Buy

For month-to-month accounting solutions like CSI Bookkeeping & Pay-roll, this is component of our consisted of. Your regular monthly accountant will not just prepare your tax return like a yearly accounting professional does; they will likewise help you. This way, you won't be hit with surprises on your tax return. They will likewise ensure you remain in compliance with all changing tax regulations and represent you in instance of an audit (Frost PLLC).

An annual accounting professional can't help you with tax obligation strategy due to the fact that they are just in your publications yearly, but tax technique is a significant selling factor of regular monthly accounting. When it comes to a bookkeeping solution, you actually do obtain what you pay for. Your accounting professional should not just be a business expenditure; it ought to be a real investment in your firm.

You're putting together or updating your listing of tiny service bookkeeping services. You also require to know what solutions reverberate with business owners (give the people what they want!). Check out on for a listing of audit and tax services for small businessand beyondyou may consider offering.

Not known Details About Frost Pllc

Plainly, clients expect you to supply bookkeeping services for little business. There are a couple of kinds of solutions you can classify as real "accountancy" solutions, consisting of: Tax preparation news and speaking with Auditing Cash circulation forecasting Financial declaration analysis and analysis Certain, your customers might make use of bookkeeping software application to manage their transactions and produce economic statements.

Currently, many thanks to on-line pay-roll, this is one accountancy solution for little company you don't want to miss. Customers expect accountants to provide pay-roll services.

Last but not least, among the several hats you use as an audit professional is that of a trusted expert. It's only suitable that you provide encouraging or consulting services. You may help clients: Make business and monitoring decisions Protected financing Select software program or services that can help their business Advising is one of those services that comes naturally when your customers turn to you for aid with their books.

You can additionally collect responses from clients via e-mail studies. This is not intended as lawful suggestions; for additional information, please go here..

Getting The Frost Pllc To Work

Local business frequently outsource some or every one of their accountancy feature to access to know-how at a fractional expense. There are 3 kinds of accountancy services small companies can buy: accounting, critical money, and tax audit. These main kinds of accountancy cover most of potential services. Local business acquire solutions in these 3 kinds of tiny business accountancy: The major role of a bookkeeper is to classify and resolve business and financial purchases.

Their duty is to provide exact and timely financial details for the company and document monetary purchases. Strategic finance is a large bucket that is usually damaged down right into controllership and CFO services. Controllership is oversight and administration of the accounting process. This could imply improving procedures, managing/building projections, economic reporting, monetary review conferences, and recommending renovations.

Tax obligation bookkeeping has two major functions: conformity and approach. A tax accountant's primary function is click for info to ensure a company is certified with federal, state, and local tax legislations. Their additional duty is to offer calculated advice as to just how to optimize your bucks within the taxes. An instance of this is checking out a business's certifying reductions.

How Frost Pllc can Save You Time, Stress, and Money.

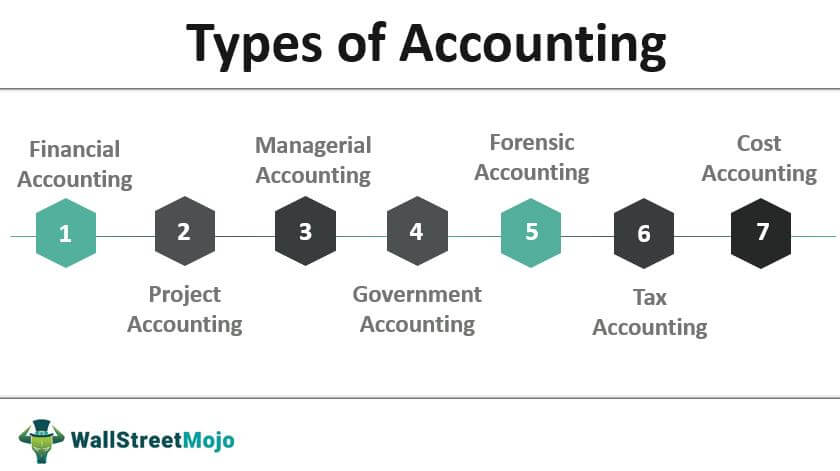

General accounting systems are personalized to your organization and assistance fulfill the needs of most organizations. Industry-specific accounting software program systems There are 3 primary types of accountancy: tax obligation, economic, and price.

Financial accountancy involves bookkeeping and calculated money. Cost audit, additionally recognized as supervisory accountancy, is comprehending the cost a business sustains to create a product and the earnings a business earns to sell it.

These features of accounting ensure organizations are compliant and have a logged record of their click for more financials. Savvy entrepreneurs likewise seek out tactical bookkeeping solutions.

The smart Trick of Frost Pllc That Nobody is Discussing